Are you new to the stock market and curious to know the basics of it? The stock market, also known as the share market or share bazaar, refers to a marketplace where shares and other investment products are traded. Let’s delve into the essentials of the share market and how it operates.

- What is share market in simple words?

- What is share or stock?

- Companies and investors are the main entities of the share market

- Other entities involved in the share market

- Share market facts

- Guide to get started in share market in India?

- What is DEMAT account?

- Benefit of investing money in share market?

- Securities traded on the stock exchange?

- How actually stock market works?

- Beginning of share market

- History of share market in India

- How to learn more about share market

- Importance of the share market

- Conclusion

- FAQs

What is share market in simple words?

Simply, we can define the Share Market as the place where people can buy and sell shares of a company. Stock market or share market is regulated by government and technically known as Stock Exchange. For example NSE and BSE are the two major stock exchanges of India.

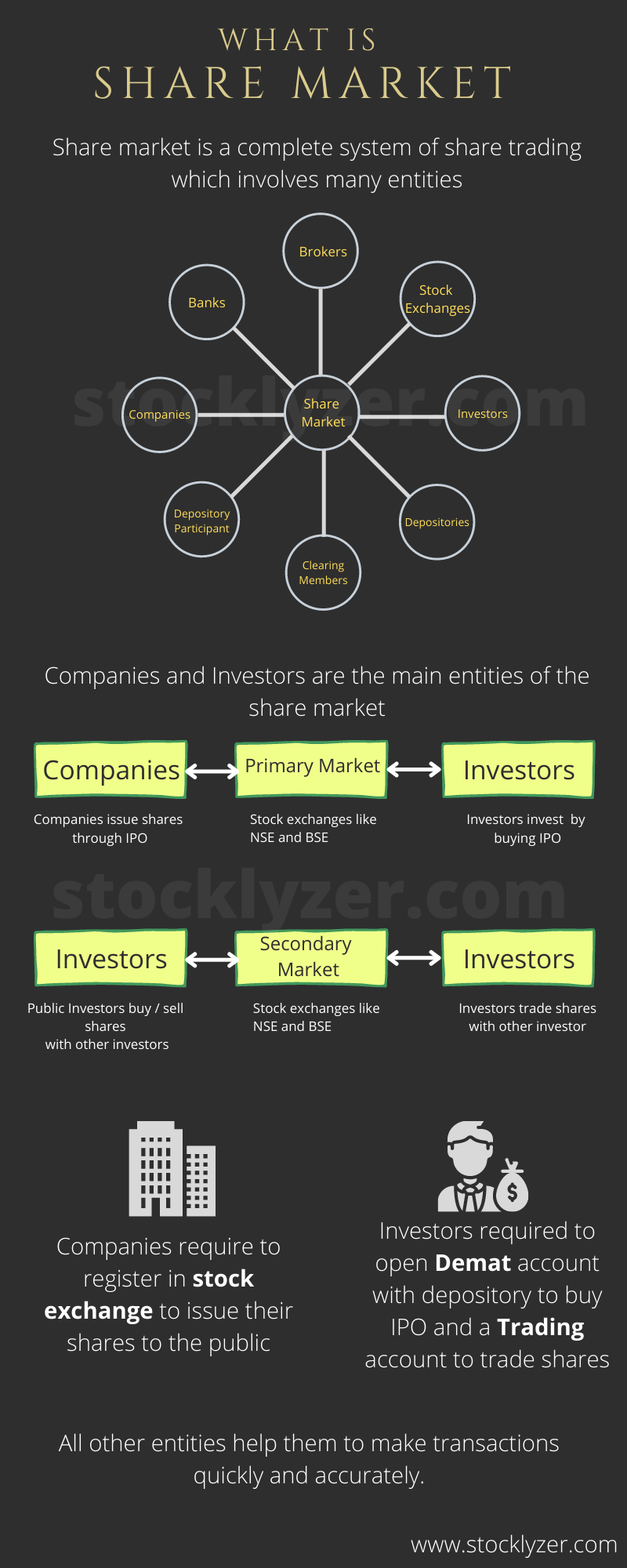

To dig deep we can say Stock market is a complete system which involves trading of stocks and other securities between investors and companies. It involves many entities to regulate everything. Let’s first understand what is a share before we go further.

What is share or stock?

A share is a unit of ownership in a company. A person who owns shares in the company is called an investor or shareholder. Owning shares gives the holder the right to vote at shareholders meetings and to receive dividends (a share of profits) from the company. In India for every public limited company it is required to issue at least 25% share to the public.

Shares are also referred to as stock or equity. After you purchase them, you will be referred to as a stockholder or shareholder of the company.

Now let’s understand what is share market?

In share market stock exchanges are the entities where actual transactions takes place between companies and investors. It is a public market place that offers a way for companies to raise money, and for people to invest in the companies.

Companies and investors are the main entities of the share market

Companies get listed with the stock exchanges after fulfilling all the compliance and then issue initial public offer (first time issuing of the shares to the public) through the primary market. Where an investor purchase directly from the company through bank or broker.

There are many type of investors like

Retail investors : Small investors are known as Retail investors.

Institutional Investors : Big institutions like Banks and companies are known as institutional investors. They could be Domestic Intuitional investors (DII) or Foreign institutional investors (FII).

A retail investor must have to open a Demat account before they can apply for IPO. Later on to trade shares they also require to open a trading account.

Other entities involved in the share market

Stock exchanges : Stock exchanges plays important role and it the place where all the transactions happened. NSE and BSE are the two major stock exchanges in India.

Depositories : Depositories are the government bodies which issues Demat accounts and hold the records of all the demat accounts and their share holding.

Depository participants (DP): help to open a demat account with the depositories and are responsible to transfer the shares to the demat account. NSDL and CDSL are the two depositories in India.

Stock brokers : Stock broker also plays important role to complete the whole transaction smoothly. They provide a trading account and a software to show the stock exchange data and take place the trade easily. Mostly all stock brokers are depository participant and can open a demat account. So stock broker are the primary source of contact for a retail investor to get started in the stock market. Here is a list of all the stock brokers in India

clearing members : Clearing members helps in clearing and settling the transactions successfully between two parties.

Banks : Primarily banks are used to do the banking transactions like to transfer fund to or from brokers. Secondary mostly all major banks are the stock brokers and depositary participants. So a bank account can also open a trading account and demat account. Banks also play important role in buying an IPO through ASBA facility.

SEBI (Securities and Exchange Board of India) oversees and regulates all of India’s major stock markets, companies, share brokers and investors.

Share market facts

You’re putting money into the company when you purchase share of a company. And you become the shareholder of the company. As the business expands, so may the value of your share. It is possible to make money by selling the share on the open market. The price of a share can be affected by a slew of different variables.

A company must list their shares in the stock exchange by offering IPO. With the help of IPO companies raise funds from the public to grow their company. IPO is an initial public offer after that public can trade shares of the company in the stock exchange.

Companies usually do not buy or sell their own shares in the exchange except some special cases where they must have to inform this to the exchange in advance. So only public entities trade through share market.

Actually public also can not trade directly and they need a mediator known as Stock Broker or Share broker. As an intermediary between the stock exchange and the investors, brokers are needed. So stock exchange settle the trade with the broker and not directly to the public investor.

A stockbroker helps investors to complete the transaction in share market. For this reason, before you can begin investing or trading, you must first open a demat account and an online trading account through a broker. Here is a list of all the brokers registered with SEBI.

There are approx. 1700 companies listed in NSE and more than 4000 companies in the BSE. Some companies are listed in both exchanges. Check all the companies listed in the Indian share market.

Guide to get started in share market in India?

In India to start buying selling in share market a person need to open an account with a stock broker. Stock broker will automatically open the DEMAT account of the client with the depository.

Stock brokers are SEBI registered companies or individuals who provide facilities to execute the buying and selling of shares smoothly.

What is DEMAT account?

Now lets understand what is this depository account or DEMAT account. Depositories are the government bodies which hold the records of all the share holders and all their share holdings. In India there are 2 depositories CDSL and NSDL. So basically a person require below accounts to start buying or selling in the share market.

1. Bank Account

2. Broker Account (Broker will automatically open the DEMAT account attached to their broker account.

You may open an online trading account & demat account from the comfort of your own home using a simple online process through a stock broker. But keep in mind always check if a broker is SEBI registered broker.

Benefit of investing money in share market?

People invest money in the share market to make money or for the passive income where they can get good return on their saving by investing money in the companies. When a company grows and make profit, a share holder also get the benefit in proportion of share holding.

Some people also make money by trading shares very frequently. Even buy and selling shares everyday. Which may give them more return on their investment, but again that is very risky.

So people invest in share market in two forms long term and short term. People who invest for long term are known as investors and people who invest and reinvest for short term are known as traders.

There are mainly two ways where people make money by buying and holding shares for long term.

1. Dividend

A company makes money and distributes it to its stockholders in the form of dividends. Company may declare dividend once in a year or many times a year as per outcome of their board meetings.

Dividend is declares as per share bases or the percentage of the face value of the share. (Note that share’s face value and market price is different). Companies financial results declared every quarter of the year. So they may declare the dividend in any quarter. A quarter is a 3 months period.

Check the upcoming dividend declared by the companies.

But it is not necessary that a high paying dividend company is always a good company. Some companies pay less dividend and use the money for the further expansion of the company. So the value of the company go up and the price of the share will also go up.

2. Capital Appreciation

When the net worth of the company increases the value of the shares will also increase and this is known as capital appreciation. You get the maximum capital growth as long as you hold the shares for long time.

The 3rd method is by trading shares frequently.

3. By Trading

Trading is the buying and selling stocks on daily bases or for a few days. A trader trade in equity by paying full money or with the margin money. You can know more about these terms in this guide: How to trade in share market. Many people also trade in Future and options. Where you can trade contracts of share sale / purchase by paying a premium amount. Know more about Future and Options.

Again trading is very risky and it can wash whole capital or could make it double in just a single day. Some people trade in cash equity and some people trade in future and options.

Difference between trading and investing in stock market

Securities traded on the stock exchange?

‘Security’ in the share market is a term used to describe an investment that can be traded on a stock market or share market. A security is a tradable financial instrument, like stocks, bonds and mutual funds. It represents ownership in a corporation or part of the company’s assets and earnings. The stock exchange or stock market trades four distinct sorts of investment products. These include the following:

1. Shares or Stocks

A share is a unit of ownership in a corporation. Shareholders are entitled to receive any profits earned by the business in the form of dividends. Additionally, they bear the brunt of any losses incurred by the business. Check all the companies offering shares in India.

2. Bonds

A business requires significant money to pursue long-term, lucrative projects. One method of raising funds is to sell public bonds. These bonds symbolise the company’s “debt.” Bondholders become the company’s creditors and are entitled to timely interest payments in the form of coupons. From the bondholder’s standpoint, these bonds function as fixed income instruments, as they provide both interest on their investment and the principal amount invested at the end of the specified period.

3. Mutual Funds

Mutual funds are professionally managed financial products that aggregate the money of multiple investors and invest it in a variety of financial instruments. You can find mutual funds that invest in a number of financial categories, including equities, debt, and hybrid funds.

Each mutual fund scheme issues units with a fixed value comparable to that of a share. By investing in such funds, you automatically become a unitholder in the mutual fund scheme. When the mutual fund scheme’s instruments make money over time, the unitholder gets that money in the form of the fund’s net asset value or dividends.

4. Derivatives

A derivative is a security whose value is derived from another security. This can include stocks, bonds, money, and commodities, among others! Buyers and sellers of derivatives have very different views about how much an asset will be worth in the future, so they make a “contract” on how much it will be worth in the future. Check all the derivatives listed in Indian stock market.

5. ETF

ETF stands for Exchange Traded Fund. It is a type of investment fund that is traded on the stock market and tracks the performance of an underlying index. It is a market-weighted portfolio of stocks.

Actually, we can say, ETF is a type of mutual fund that trades like a stock on the stock market. It is called an exchange-traded fund because it can be bought and sold just like stocks on an exchange. The price of the ETF fluctuates throughout the trading day as supply and demand for the shares rise and fall.

How actually stock market works?

Consider a business that is doing well and earning profits on a consistent basis. The business now wants to expand its operations and business to other locations. To expand the business, the company will require a significant amount of funds or money. This is when the stock market enters the picture. In an Initial Public Offering (IPO), companies issue shares (also known stocks).

This introduces the company to the official public market, Where any company or individual who believes the business will be profitable can purchase the company’s shares. By purchasing shares, investors become partial owners of the company. This investment aids the company in growing and increasing its profitability and success. When a business becomes more profitable or successful, more buyers get interested and begin purchasing shares.

As demand for those shares increases, the price increases automatically, raising the price for new buyers and raising the value of companies’ shares already owned by shareholders. Increased interest allows the company to fund new projects while also raising the value of the company as a whole. However, if a business does not make a profit for any reason, the inverse might also occur.

If investors believe their stock’s value will decline or the company’s performance will deteriorate, they will sell their shares in the hope of profiting before the company’s value deteriorates further. As shares are sold, demand for the stock decreases. The stock price declines, and the market value of the company also decreases.

Now let’s talk about the brief history of the stock market.

Beginning of share market

If you are new to the stock market and are uncertain about what it is or how it works, then this historical story will help you to understand it.

The Dutch East India Company employed hundreds of ships to trade gold, spices, and silks throughout the world in the 1600s. However, running this massive operation was not inexpensive. To fund their expensive voyages, the company relied on private citizens who are willing to invest funds to support the trip in exchange for a share of the ship’s profits. This practice enabled the company to afford even grander voyages, hence increasing profits for both the company and its investors.

Inadvertently, the Dutch East India Company created the world’s first stock market.

History of share market in India

The Indian stock market dates all the way back to the late 18th century, when the trading floor was located opposite the Town Hall in Mumbai, beneath the shade of a large banyan tree. A few people would gather under this tree to conduct informal cotton trades. This was mostly because Mumbai was a busy port where important goods were traded a lot.

Let’s find out timeline & facts of Indian stock market

- In 1850, the Companies Act was enacted, and investors began to take an interest in corporate securities. Around this time, the concept of limited liability was also introduced.

- By 1875, a group called ‘The Native Share and Stock Broker’s Association’ was formed. This was the forerunner to the BSE.

- The Ahmedabad Stock Exchange was started in 1894, and its main goal was to make it easier for people to buy and sell shares in the city’s textile mills. The Calcutta Stock Exchange was set up in 1908 to make it easier to buy and sell shares in plantations and jute mills. The Madras Stock Exchange was founded in 1920.

- In 1957, the Government of India approved the BSE as the first stock exchange under the Securities Contracts Regulation Act.

- The SENSEX index was introduced in 1986, and the BSE National Index in 1989.

- SEBI was established in 1988 to monitor and regulate the securities sector and stock exchanges in India. In 1992, it became a fully autonomous body that could do what it wanted.

- When the National Stock Exchange (NSE) was started in 1992, it was the country’s first demutualized electronic exchange with the goal of making the market more transparent. The NSE was started in 1992.

- The NSE began operations in 1994 in the Wholesale Debt Market (WDM), 1994 in the equity market, and 2000 in the derivatives market.

- People used to trade on a open floor at the BSE. In 1995, the BSE switched to an electronic trading system.

- This is what happened in 2015: SEBI joined forces with the Forward Markets Commission (FMC). The goal was to improve commodity market regulation, encourage domestic and foreign institutional participation, and make it easier to launch new products.

- NSE started its International exchange NSEIX in GIFT IFSC in 2017.

How to learn more about share market

The content here is just a basic information about the share market. To learn more there are many authentic places like popular brokers have created lots of resources for their customers. Like zerodha varsity is free for everyone to learn about share market.

Check below books helpful to understand the concept of the share market.

Importance of the share market

Share market has a significant role for the companies and for a country. Performance of the share market shows the economic performance of a country.

Companies can raise money for a variety of purposes by issuing stock to the general public. After the IPO, the firm is listed on the stock exchange, making it possible for even the most casual investor or trader to own shares in the company.

For a country it acts like an indicator for the economic condition and growth of a country.

Conclusion

People who are curious that “what is a share market?”, hopefully get their answer through this article specially for the beginners. So simply it is marketplace where public buy and sell shares of public limited listed company through the stock exchanges. To start trading a person require to open an account with a share broker. And then connect the bank account to the broker account to get started. Before investing or trading in share market always be educated. As it provide more return but it is also risky.

Now we know everything to get ready for the investing by knowing every basic knowledge about share market. Next topic to learn is How to invest wisely in stock market.